Recently, some media have stated that the refined oil consumption tax will be reformed in the collection process, or pilots will levy a refined oil consumption tax on consumers at petrol stations, that is, expropriation from enterprises will be levied on individuals. Therefore, it is not unrealistic for consumers to get a refueling document containing taxes and fees in the future.

Some institutional analysts have calculated that in the first half of this year, only two types of excise taxes advanced by PetroChina and Sinopec were as high as 140 billion yuan. Therefore, "taxation of refined oil to individuals" will greatly reduce the financial pressure on oil companies.

However, whether “taxation of refined oil products to individuals†will be implemented in the near future and is not expected by the market. Industry insiders believe that there are many difficulties in collection.

"Two barrels of oil" or easing the pressure on funds This topic was discussed as early as a few years ago when China's refined oil (gasoline and diesel) consumption tax reforms began.

China's reform of refined oil products and taxes was formally implemented on January 1, 2009. It covers the increase in the unit tax on refined oil consumption tax, in which the consumption tax on gasoline has increased from 0.2 yuan per litre to 1 yuan, and diesel has risen from 0.1 yuan per litre. 0.8 yuan, but the "in-the-money levy" method was still used.

An insider of CNPC told reporters that one of the benefits of “in-the-money collection†is that it is not easy to leak taxes.

Dozens of refineries, including PetroChina and Sinopec, do not have large scales of collection. Every day or at regular intervals, the taxation department will come to collect data and fees related to consumption tax. Therefore, “in-cash collection†is still used. Until now.

Assume that the “in-price collection†is changed to “extract from the priceâ€, then PetroChina and Sinopec and other companies do not need to advance this expenditure, which will help reduce the cost pressure of “two barrels of oilâ€.

Zhang Zhuo, an analyst with Zhuochuang Information, told the newspaper that the domestic diesel and gasoline production in the first half of this year were calculated at 84.9 million tons and 42.7 million tons, respectively, and the two types of consumption tax estimated to be advanced by the “two barrels of oil†were as high as nearly 140 billion yuan. It's not a small sum of money. Obviously, PetroChina and Sinopec may also need to borrow money from banks or other financial institutions first, or repatriate the revenues of petroleum and chemicals obtained from their sales as soon as possible to maintain the company’s normal operation.

In addition to the reduction of over 100 billion yuan in advances, another major advantage of the conversion of the consumption tax to oil producers is that the production units do not have to pay the bills for consumers.

In the past, the tax authorities directly levied consumption taxes such as gasoline and diesel on the oil production chain, and there were volatilities in the petroleum products from production to transportation and sales, and some of the gasoline and diesel oils were not necessarily 100%. Sales, so oil companies may spend some more taxes.

Road twists and turns, bright future?

The method of consuming tax on refined oil cannot be implemented immediately.

Zhang Bin said that although China may start with pilots for extra-exemption from gas stations, but because there are a total of about 100,000 gas stations, whether each gas station can use a sufficient amount of refined oil consumption tax as a “leakage†It's hard to say to the tax authorities. In other words, after the taxation of consumption links, the taxation base will be greatly increased, and the difficulty of tax collection will also increase.

Overseas, on the invoice or receipt of each item, the sales price, tax rate, and tax payment amount of the item will be clearly stated. In the future, China's gasoline and diesel receipts may also have similar details.

A person in charge of a gas station told reporters that if refined oil were to be subjected to "exemption from the price," then each company's refueling tax control machine or billing machine would need to be updated (such as software and printing equipment, etc.).

Secondly, in China, most of the refined oil used by industrial and mining companies comes from wholesale and direct sales channels, and the amount is not low. If China's “exemption from consumption†excise tax is only to be promoted from gas stations, how should the implementation of the taxes and fees for oil products for wholesale and direct sales be implemented? Is it still paid by the oil production department? And how does the production department distinguish between the wholesale and direct-sale oil products and the retail oil products sent to gas stations?

In 2011, Sinopec's direct sales volume and wholesale volume of refined oil products were 33.22 million tons and 17.7 million tons respectively, accounting for 33.6% of the total sales volume. This proportion shows that the taxation of direct sales and wholesale in China is not low.

Zhang Yonghao, analyst at Zhongyu Information, believes that the significance of changing tax collection methods is that consumption tax is changed from implicit to explicit. In the short term, consumers may have rebellious attitudes and social purchases will be moderately reduced, but in the long run this will benefit consumer rights.

"After the levy is adjusted, the tax revenue will be dissociated from the retail price of refined oil. The retail price of refined oil will be more transparent and will help reduce the retail price," said Zhang Yonghao. The logic that the retail price may be lowered is that, on the one hand, the production funds of the production enterprises are released, and the enterprises can reduce the production costs; in addition, whether the bare tax price of gasoline and diesel is too high or whether it is in line with international prices is even more clear.

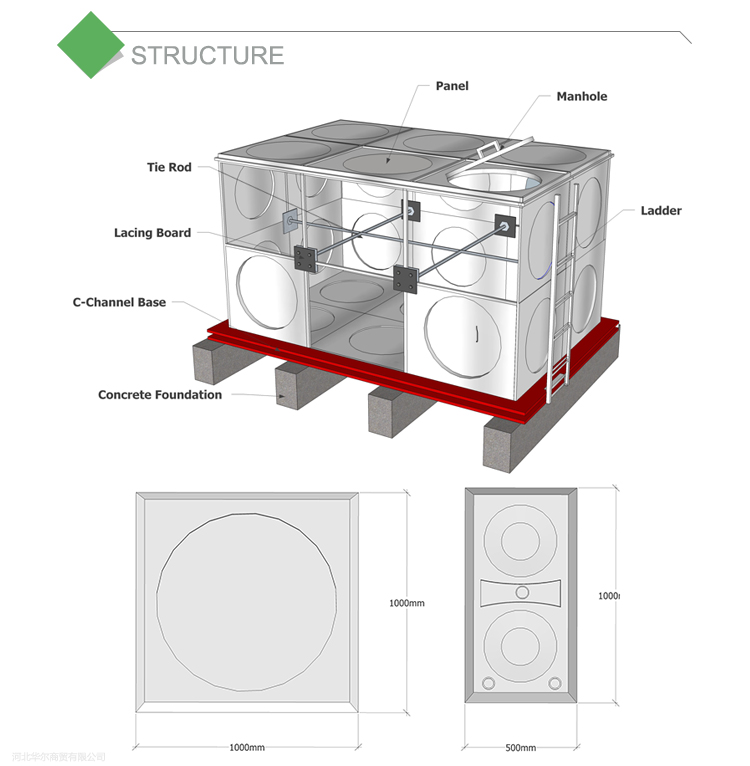

Welded Stainless steel water tank is made of SUS304 stainless steel sheet and by mould pressing.

Compare with other tanks, it has many advantages, such as good looking light weight, high strength, anti-corrosion, heat-resistant, clean water quality, seepage-proofing, anti-seismic, easy installation, convenient cleaning, maintenance-free and some so on.

Stainless Steel Water Tank Mould Features and structure:

1) Strong resistance to corrosion.

Stainless Steel Water Tank Mould Panel size for your reference:

Water tank size: Can be made as your reuqest.

Panel size: 1mx1m, 0.5mx0.5m, 1mx0.5m

Wall board thickness: 5mm,8mm,10mm,12mm,14mm,16mm etc.

Stainless Steel Water Tank,Stainless Steel Tank,Steel Water Tank,Stainless Water Tank

Hebei Long Zhuo Trade Co., Ltd. , https://www.hblongzhuo.com